Successful applications

Artificial Intelligence has been successfully used by leading teams in a variety industries. The same is true for Machine Learning if on a smaller scale owing to the younger nature of the field. If we take the readily accepted definition of AI as machines that are capable of not just executing but storing complex commands, then AI has been around in a practical sense since the late 1950s. Practical applications of Machine Learning really began to emerge after the 1980s AI Winter with a renewed focused in data discovery methods when complicated relationships and patterns in data processing methods were found in the 1990s. Deep learning appears to have taken off only this past decade and given the early state of many of the applications, the field of Deep Learning likely need more time until companies form around the transformational impacts enabled by the technology.

There are thousands of companies in these different fields. To simplify the scope of reviewed solutions, this piece will outline the leading applications of Machine Learning and Deep Learning by companies who have developed something unique and impactful, focusing on the largest companies and the startups that have received the most financing.

| This segment will cover: | |

|---|---|

| 1 | Learning systems providers |

| 2 | Chatbots and AI assistants |

| 3 | Computer vision systems |

| 4 | Robotics and self-driving cars |

| 5 | Smart cities, homes and stores |

| 6 | Improving machine-human interfaces |

Learning system providers

Microsoft, Amazon, Alibaba, Tencent, IBM and Google are more generalists than exclusively ML-focused. They have each developed comprehensive Machine Learning systems and are working actively with different companies who have domain specific expertise. Their collective aims are to combine their technical expertise with the subject matter expertise of their client companies to create innovative solutions. There are other teams like DeepMind, acquired by Google in 2014 for more than US$500 M, and ElementAI, with US$257.5 M in financing, that compete against these six players primarily through their Deep Learning and Neural Network expertise. They are following this approach because it is an excellent way to generate revenues, access the existing customer relationships and bypass many regulatory challenges in the different industries where ML can have significant impact. The six companies mentioned earlier also offer ML optimized cloud systems built using the hardware provided by Nvidia and Intel among other hardware specialists. Beyond the systems and the hardware, it seems as though every major technology leader has developed a framework that most have open-sourced to make it easier for engineering teams without much data science expertise to incorporate ML into their applications with other players like Facebook and many open source options also available.

Solutions for technology teams

Training and deploying Machine Learning models is costly and time consuming – especially if a company is working with extensive legacy systems and teams of personnel who do not have applied experience with the practice. A large number of entrants have built applications and systems that embed well into existing tech stacks on the Microsoft, AWS and Google architecture that many companies are using. The ideal situation for every company is that they are able to develop an organizational advantage with a deep competency in ML systems and models that drives a gap between their products and those of their competition. Incorporating Machine Learning through time and effort saving products from different providers can be a great solution for companies looking to simplify their adaption to Machine Learning and they should bear in mind how these tools might limit their teams in certain areas. Specifically, how these systems could impact future functionality improvements, performance implications and cost considerations from the continuing use of a system or switching to another.

The most popular open data processing, preparation and management framework is Apache Spark, though there are many others to select from that can be more useful for teams dealing with specific problems or working with specific tech stacks. Databricks has raised US$897 M and grown significantly by making it easier for data scientists and teams to generate value out of their data that runs on Apache Spark. A competitor to the Apache Spark, Databricks model is Splunk that went public in 2011 with a valuation of $1.6 B. Splunk favours the Apache Hadoop framework and focusing on data available and actionable to company management in real-time. DataRobot, with US$430.6 M operates in a closely related space and this teams focused on helping data scientists identify the best Machine Learning models for the problems they’re focused on. Snowflake with US$1.4 B bills itself as the modern, cloud-based data warehouse by focusing on the increasing data storage and management needs related to data-intensive businesses like those based on Machine Learning systems – it can be used in conjunction with systems like Databricks. Looker, a Tableau and Splunk competitor acquired by Google for US$2.6 B, uses Machine Learning techniques to analyze data similar to Splunk.

All these players are working hard to sell the pickaxes to businesses out looking for gold while competing with products like AWS Sagemaker, Redshift, IBM Watson Studio and Microsoft Machine Learning Studio designed to keep companies using the products offered by their existing tech stack providers. It is a messy space and these players are doing what’s needed to expand their territories while integrating into each others systems to benefit their shared customers. It is worth nothing that TensorFlow, the framework provided by Google focused on making it easy to create Deep Learning Neural Networks, does connect with the Apache Spark framework used for more general Machine Learning systems.

A big area of concern in the medical world is the development of new medicines and it results in one of the largest Research & Development spending-to-revenue ratios in Healthcare compared to all other industries. The initial and largest discoveries in new medicines came primarily from a trial-and-error method with more advanced and focused methods developed as needed. Now, like in seemingly all other industries, new discoveries have to be pursed using more sophisticated methods to be effective and affordable. BenevolentAI with US$292 M in funding is going after the problem directly and is not alone in the space as Zymergen approaches the same problem with US$594.1 M albeit in a more industry agnostic manner.

The generalists are heavily involved with leading companies in the healthcare space with a great example from Microsoft’s Project InnerEye where Mircosoft is working with the UK’s National Health Service to have them adopt the 3D representations of radiological, diagnostic images for more effective surgery planning and navigation. With IBM’s Watson AI technology, Pfizer uses machine learning for immuno-oncology research about how the body’s immune system can fight cancer to decrease drug discovery costs but due to limited economic feasibility, IBM has since decided to withdraw the offering. In September 2019, Google joined their Health team with DeepMind Health to drive greater value from their 2014 acquisition. DeepMind already demonstrated significant capabilities in the HealthCare industry working with the US Department of Veteran Affairs to test and showcase the effectiveness of their mobile health assistant. Another data-focused company supported by Google/Alphabet is Verily that has raised US$1.8 B in private rounds to create a massive dataset of medical information and create actionable insights from the gathered and available data.

Hardware Providers

Hardware advancements and capabilities can be a significantly limiting factor for businesses applying Machine and Deep Learning systems to solve customer problems. Indeed, many Deep Learning techniques have been developed specifically to decrease the total time required to process complex calculations by executing parallel commands with Graphical Processing Units (GPUs) or Tensor Processing Units (TPUs) rather than sequential ones with Computer Processing Units (CPUs). GPUs have been repurposed for Deep Learning and complicated Machine Learning systems from their origin function handling highly detailed monitor and screen pixelated displays. There is a strong similarity between doing the parallel calculations needed to render a large number of pixels with different colour or tone results and the calculations needed for a Neural Network with a large number of nodes or paralleled calculations, which is why GPUs have risen as a preferred option.

The incumbents in chip manufacturing are all working hard to develop AI, Machine Learning and Deep Learning specific components. The current leader from this group is NVIDIA followed by Intel, Qualcomm-acquired AMD and Taiwan Semiconductor Manufacturing Corporation. These companies are all publicly traded and have been around for some time. Microsoft, AWS, IBM and Google have all incorporated components from the first group of providers into their systems to create Machine and Deep Learning environments though Google has gone so far as to create the TPUs – chips that are designed specifically to support the open framework TensorFlow they developed. Graphcore with US$460 M, Wave Computing with US$203.3 M, Cerebras Systems with US$112 M, Cambricon with US$200 M, and Hailo with US$87.9 M are all developing next generation processing components to deal with the challenges around training and applying Machine and Deep Learning systems to disrupt the markets currently served by the aforementioned incumbents.

Chatbots and AI assistants

With the advent of smart devices and the much cheaper availability of processing power, many companies have entered into making it easier for businesses and people to have robots handle more of the mundane, repetitive tasks that we encounter on a daily basis. The idea here is to make people and businesses more efficient by freeing up our time and energy for more creative, profitable pursuits. As well, an aspect of this efficiency brings an auditory or spoken feature into these machines as many of the tasks that are designed to handle are completed through phone conversations. The best method for interacting with machine intelligences seems to be through code while the preference for human intelligences is more through natural conversations and more unstructured speech – these bots are moving along the spectrum to be more human focused in their interfaces.

At Google’s 2018 IO, they unveiled the capability of their systems to handle conversations with humans without entering into the uncanny valley and making the conversation participants uncomfortable with a robotic conversation. Facebook had also developed the M chat interface to provide a virtual assistant for users but has since opened up their Messenger application as a platform and channel for 3rd party developers to build their own chatbots for consumers and businesses. Google, Apple, Slack, Microsoft, Twitter, Twilio and other publicly traded companies have all opened developer experiences for teams looking to leverage chat, SMS, social media, email, voice and other interface channels for their bots to talk with people and, one day, other bots.

Outside of the platform and channel providers there have been a collection of teams using these channels along with channels of access that they developed themselves. Amazon with Alexa, Google and Apple with Siri have all developed voice-activated devices to give customers an easier means of access to their content and simple query responses. Rokid with US$158.3M has developed glasses with an embedded camera and VR display to act as an onboard visual assistant. Staying away from the manufacture of devices, SoundHound with Soundhound US$215 M has focused on developing a conversational, voice interface that businesses who manufacture devices can use to incorporate voice activated commands and responses into their feature set. Teams that use these channels to drive sales are a B2B market that is actively approached by a number of competitors. With a strong lead in CRM solutions, SalesForce developed Einstein to work with sales teams to improve their efficiency and to provide management with critical insights on their teams performance. Other entrants with sales assistants include Gong.io with US$133.1 M, Seismic with US$164.5 M, Highspot with US$196.9 M and SalesLoft with US$145.7 M.

Digital content platforms Spotify, Facebook, Twitter and TikTok have all heavily incorporated ML into their platforms to help users discover highly relevant content more easily and to moderate what information is being shared on the platform. Spotify and TikTok have been particular successes with their applications of discovery experiences with increasing number of users on Spotify relying on the discovery features to consume content and TikTok being able to achieve massive growth with younger demographics primarily through sharing viral content quickly on feeds largely managed by ML. Facebook with over two billion users on their various platforms have been able to achieve amazing growth but has found intense criticism for their inability to actively ensure safety for users by allowing hate speech, an outcome of perhaps focusing too much on just connecting people, rather than ensuring the connections are positive as Facebook is now trying to do. Of these companies, all are unicorns and only ByteDance, the owner of TikTok is still private with a total raised funds of US$4.6 B.

In healthcare, the application of data-based learning and processing has the potential to radically improve the level of care received by patients by improving the efficiency and efficacy of doctors, nurses and other medical professionals. A great example of a project that is leading the way is Ada Health who are using ML methods to give patients an effective means of self-diagnosis before seeking attention from trained medical professionals. This Berlin-based team has raised US$69.3 M and could dramatically decrease unnecessary hospital visits while improving patient self-care. A direct competitor that offers a solution with a more comprehensive set of features is Babylon Health. Babylon Health is a London-based team with US$635.3M in funding that focuses on using smartphones and tablets as a means to access health professionals and using ML with patient specific data to generate diagnoses.

The application of Machine Learning has also reached into the consumer world with businesses like the aforementioned Ada Health and Digit. Digit has raised US$63.8 M to help people devise and maintain better savings habits based off predictive systems that automatically withdraw amounts to meet specified goals within the allowance of past and predicted finances. Their competitors for Fintech customers include WealthSimple that raised US$192.4 M before being acquired earlier this year and WealthFront with US$204.5 M who are both developing more advanced trading bots. The use of AI and Machine Learning by investors and traders is not a new development with 56% of hedge funds reporting that they are using these systems and many are using a combination of different systems to ensure they maintain a competitive advantage. Another leader in the consumer assistant industry is X.ai with US$44.3 M. This team has developed an application that embeds in an email client and with a separate email address that schedules meetings between people with asynchronous calendars. These people exchange communications with Amy or Andrew who proposes times and follows up with the meeting attendees until a time that works for everyone is found.

Computer vision systems

Earlier this segment went through the different efforts made by companies to digitalize and make comprehensible audio input so that people can interact with machines in a more human way. We humans have developed a capacity for language that helps us communicate ideas and explore plans with each other and we’ve have developed this capacity over generations in an ever evolving framework. Visual input is something that we commonly think of as art where it makes us feel or react to certain objects in new and powerful ways. This input type is a powerful aspect of determining our reactions to the world and our ability to recognize patterns or stimuli in our environment is crucial to our growth and success in many situations. Improvements in our ability to create devices that register this information along with better data processing techniques has allowed us to create machines that generate critical insights from visual information gathered in specific situations.

Industries with physical assets that require monitoring, maintenance or inspection like agriculture, energy, insurance, law enforcement, defence, transportation and shopping have all begun to explore how computer visions systems can enhance their value. Three leading companies in the application of computer systems for agriculture, energy and businesses with large commercial properties are PrecisionHawk, Drone Deploy and Orbital Insights with US$136 M, US$92.6 M and US$128.7 M respectively. PrecisionHawk and Drone Deploy are both using computer vision with drone technologies to monitor and generate insights. While Drone Deploy is looking to operate more as a platform for a variety of developer applications, PrecisionHawk integrates satellite imagery with their drone capabilities. Orbital Insights focuses only on using computer vision through satellites which is a more cost effective solution for large hectares of land while drones are best for more localized solutions and have the possibility of providing effective maintenance as the robotics and software systems advance. Planet Labs with US$351.1 M operates as a competitor to Orbital Insights and is differentiated in it’s offering by having a network of proprietary satellites in orbit rather than pulling in a variety of data sources managed by other parties. Flir Systems with a market cap of US$4.67 B developed hand-held computer vision devices for teams on the front-lines of infrastructure, energy and defence initiatives that can connect to decision-making systems.

In healthcare, computer vision companies are creating solutions to improve patient malady diagnosis and care by aiding medical personnel providing treatment. A clear leader in terms of scale is Butterfly Network that has developed a tricorder-like medical device that emits ultrasound waves to scan different parts of our bodies with measurement guidance built into the mobile application it connects to for scan display. The device and accompanying software has to be used by trained medical personnel, whose businesses are the targeted customers, and along with the intelligent software offering, Butterfly Network offers a solution that is a significant discount vs. more traditional devices. Similar to Butterfly Network, Healhy.io with US$90 M and Viz.ai with US$90.2 M have both focused on using the capabilities of a smartphone as a medical device, although they have both focused on using the built-in smartphone capabilities and existing medical equipment rather than developing their own devices. Healthy.io uses the camera from a smartphone along with their computer vision system to allow patients to self-monitor a few different conditions and Viz.ai integrates into hospital systems to review images and help coordinate patient care with the medical staff.

Robotics and self-driving vehicles

Drones are closely linked to the field of robotics. They can be autonomously controlled machines governed by complex decision making mechanisms with advanced sensory input devices, which is more or less the running definition of robotics. The point to emphasize clear difference in the ability of observation devices and systems vs. machines that are capable of taking actions based off those observations independent of human input. While drones are becoming more and more sophisticated, their current robotic capabilities seem to be limited to the transportation and delivery of payloads. Companies that are exploring this have been able to draw in substantial funding with Kiva, acquired by Amazon for US$775 M and Cainiao, majority owned by Alibaba for US$3.3 B leading the way by using robotics in warehouses. Nuro drawing in US$1 B has developed a delivery vehicle for out-of-warehouse use in a closely field and competitors with large warehouse networks like Walmart are now working with startups to remain competitive. The efficiencies from including robotics in complicated and high volume supply chains can greatly improve worker efficiencies, decreasing business costs but safety concerns are arising as these implementations scale.

Our societies are also developing more trust in robots, gradually allowing them to take larger roles handling more important tasks like flying in populated areas, operating large vehicles in high risk scenarios, moving or organizing parcel delivery and cleaning our buildings. However, we have enormous concerns about granting more independence to machines as poorly designed code, interrupted communications and unforeseen situations can result in very dangerous and potentially lethal outcomes. Robotic bodies are stronger and more durable than human frames and their silicon brains can process information much more quickly than our grey matter so the potential for danger is quite significant, especially in defence projects.

The current national leader in Machine Learning and AI seems to clearly be the USA and the projects that the armed forces are exploring in autonomous weapons do give reason for concern. The Israeli and Russian armed forces are exploring their own projects and while the Chinese have not declared any specific autonomous weapons projects, their government does want to be the global leader by 2030. These projects have been developed and are being tested but have not been rolled out as yet. The incumbent teams of Lockheed Martin, BAE Systems, Boeing, Airbus Defence and Space and others are all improving the capability of their war-fighting systems with more autonomous systems. It is difficult to identify if new entrants are joining with a competitive advantage in ML given the secrecy in this industry related to financing, national security and product capabilities. Boston Dynamics was acquired by Soft Bank for $100 M in 2017 and this team appears to have focused on more commercial applications of robotics though defence applications are there too.

Private property and war situations are locations where companies and teams are expected to largely self-govern with limited liability concerns, which is one of the reasons why some companies have been able to apply robotics en masse in these areas. The other reason why autonomous robots are able to be used in these settings, especially in warehouses, is that the circumstances and environments can largely be controlled. This is not a tried and true rule in all situations. Tesla was unable to have a highly automated production process for their Model 3 due to the complexity of the process and machines’ inability to handle a large number of variances in the conditions of the tasks, for example bolts that are fastened with different degrees of rotation.

Leading autonomous vehicle projects

The largest machines that we have incorporated into regular life are the cars, trucks, buses, trains, boats and planes that we use on a daily basis to transport people and packages around the world. Autonomous train systems have been in place since 2003 likely due to the highly controlled, static environments that trains operate in. The other forms of transport all move through highly dynamic environments that make it really difficult for robots to manage without decision-making algorithms built off comprehensive datasets. Singapore has had a fully automated train system in place since 2003 and the SkyTrain in Vancouver is the second longest automated metro system in the world. More and more projects for train automation will hit the market as rail suppliers move towards full automation but given the number players in semi-privatized transport systems, the success of these projects will be tied to successful stakeholder management.

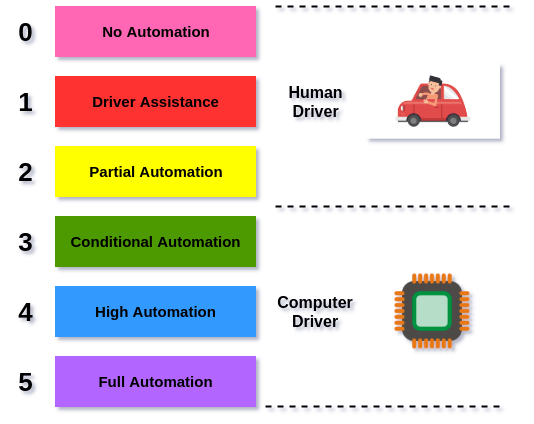

A key feature to the large investments being made in the field of autonomous driving are the relationships with regulators who allow and disallow the robots on roads. The teams that can test their technology more openly and share the roads with human drivers in live environments will be able to identify flaws in their systems. This comes at a human cost though as any accidents will endanger people. As these players race to level 5 automation, their systems will be evaluated by regulators first and markets second. A large advantage is given to Tesla, Mobileye and other providers of driver-assisted technology because these services allow them to collect training and cross-validation data to improve the accuracy and precision of their autonomous vehicles. The crucial test data will only come from robot-driven vehicles on the road when decisions have to be made in unforeseen, irregular situations.

Smart cities, homes and stores

Over half the worlds population now live in urban environments and there are more and more mega cities with incredibly dense living environments. Our density in specific environments is driving a need for collective action to alleviate the burdens we all share like air pollution, traffic congestion, criminal activity and public services access. We have developed these urban environments over generations with accepted practices and conducts developing over time, in very local contexts – it’s definitely worth reading about how the current use of roads transitioned in the USA from open public spaces to reserved thoroughfares for cars. These local practices can be adopted internationally like the use of roadways and highways, can remain more regional like the use of high-speed trains in Europe and Asia or remain very local like urban bike highways in Denmark and the Netherlands.

Urban surveillance by government and policing agencies has been heavily adopted within Chinese cities and states. Companies like Sensetime with ,US$2.6 B MEGVII with US$1.4 Band Cloudwalk with US$539 M provide facial recognition devices and surveillance systems that are used in airports, train stations, roads and throughout cities in China to monitor people and decrease crime. An important concept to note is that China has a very different constitution and concept of rights than many Western nations with multi-party democracies – the Chinese constitution views economic development as a right and Communist Party disloyalty as a crime so freedoms of expression, association and expression valued in the West, are not as protected in the East. China is not alone in the use of data and surveillance systems – the current leader in AI systems is the USA and Palantir with US$2 B in funding has taken the lead in defence contracts for digital surveillance and data analytics. Physical property rights, intellectual property rights and personal freedoms are protected by Western constitutions but digital rights and crimes are still being understood by these societies. Palantir, Google, Facebook, Twitter and other companies with data reservoirs are all operating in ‘grey markets’ while governments, lawmakers and consumers try to understand what is happening.

While there may be significant concerns in many countries relating to the governments use of surveillance devices, these concerns do not extend as much to public or commercial use. Many people have begun putting cameras on their doors to protect their property and packages. This very simple use case does not require Machine Learning – what does involve ML is when these cameras are used in conjunction with thermostats, lights, blinds and other home systems all networked together through a system that predicts the behaviours and preferences of the homes residents. This is what Nest, acquired by Alphabet aka Google for US$3.2 B and Vivant, IPO at a valuation of US$4.2 B are both focused on. Amazon and Ant Financial, aka Alibaba, have both developed smart shopping with systems that identify and track shoppers so that people can avoid the line-ups at registers, paying automatically upon exit. Companies, like Trax Image Recognition with US$386.9 M, raised are exploring taking these seamless shopping experiences outside of Amazon and China.

People want all the benefits of living in a smart city though different localities will advance and implement new technologies according to their needs and concerns. The need to adopt smart city technologies is most pressing in megacities with populations of more than ten million, eight of which happen to be in China where 5G will likely be implemented en masse first. Terminus Technologies with US$524 M is aiming to create the systems that will manage and monitor the devices available today and those that will be brought online through the new 5G connectivity for both government and enterprise customers. On the other side of the world, another leader in smart urban technologies is Sidewalk Labs. Another sub-organization of Alphabet with undisclosed financing, Sidewalk Labs plans to invest $US980 M in a project to develop a large part of Toronto’s waterfront into a futurist neighbourhood that incorporates new urban design, advanced technologies and machine learning systems for a more livable neighbourhood. As an largely American company focused on developing a Canadian city, there has been a mixed reception as Torontonians and Canadian governments try to find a way to balance the gains awarded from a multi-billion dollar development project in one of North America’s biggest cities.

Improving machine-human interfaces

Virtual Reality (VR), like Artificial Intelligence, is something that we have been incrementally exploring over time through internet innovations and video games. If we break apart what video games are, at their essence, they are imagined worlds that we can enter and interact with in varying degrees. Over time, the complexity of these worlds, our ability to mimic the real world and the interface experience has grown. With immersive head-mounted displays becoming increasing common as complements to video game experiences, the mechanics of the virtual worlds becoming richer in detail and more users coming online in shared worlds, the data loads that needs to be processed for these worlds to exist have become massive.

Unity Technologies is the leader by a fair margin in terms of scale with the Unity 3D engine who have raised US$1.3 B. Other leaders in virtual reality include Oculus, acquired by Facebook for US$2 B, who are now applying ML for eye tracking systems to make their headsets more immersive and Valve Software, with an estimated company value of $3 B in 2012 that offers a headset while also applying Machine Learning to catch cheaters in eSports. Always pressing into new spaces, Amazon has created a virtual reality builder to compete with Unity called Amazon Lumberyard, based off the CryEngine. Other interesting applications of Deep Learning in virtual realms are the experimentations being made by DeepMind and OpenAI that have built systems that can compete with the best players in the world in eSports like Starcraft II and Defence of the Ancients (DOTA). There is not an immediate commercial applications for these advancements but rather they are test cases by R&D teams to develop stronger learning programs that can be later applied to other areas. Virtual reality is being applied in urban and environmental design by teams like Matterport that raised US$114 M to build devices and systems that map and display properties for better design planning.

Cybernetic connection

As companies develop better and more immersive computer systems that are capable of doing more, our ability to interface with these systems quickly and effectively becomes a limiting factor. The same issues that we face when communicating ideas with each other, we face with computer although in a different dimension are highly effective, hyper rational agents of action. Teams focused on building better AI assistants have identified voice interaction as critical to their interface as that’s how most people like to give and request assistance information. Eye tracking is more focused on how we intake information and the headsets used by video games or virtual reality companies are utilizing eye tracking technique to simulate how our eyes work today, by putting a ‘in-focus’ and ‘out-of-focus’ grouping to images displayed in headsets.

There are many other applications of this technology and Tobii Technology with US$121.8 M raised in private and public financing rounds is developing eye tracking for cross-industry applications. Perhaps the most effective means of sending and receiving information with computers is through a direct neural connection. Nueralink, founded by Elon Musk and supported with US$158 M in financing, is mapping the human mind to develop a clear picture of how we manage information internally so that it can be communicated though a ‘neural lace’ to a computer system. Academics and not-for-profit organizations are the ones leading the conversations regarding a detailed and accurate map of the human mind as commercial applications from these advancements seem far afield. Due to the complexity of human neural systems, it is difficult to estimate a definitive end date when researchers will know that they have completely and accurately mapped the human mind to such a degree that it can be considered complete. The current definition of done that many researchers are using is to map all the our minds, in a generic sense, down to the synaptic level. Key leading teams and projects to track include the Allen Institute, the Blue Brain Project and the Human Connectome Project.